![]() 4 minute read

4 minute read

Luxury goods market has been on an upward climb for many years. The continued growth is justified with the global rising middle-class led by Asian markets. Nevertheless, the profile of luxury purchaser is changing. This article investigates the future luxury consumer who prefers local goods and keeps shopping as one of the priorities while traveling.

Self-expression

of young luxury buyers

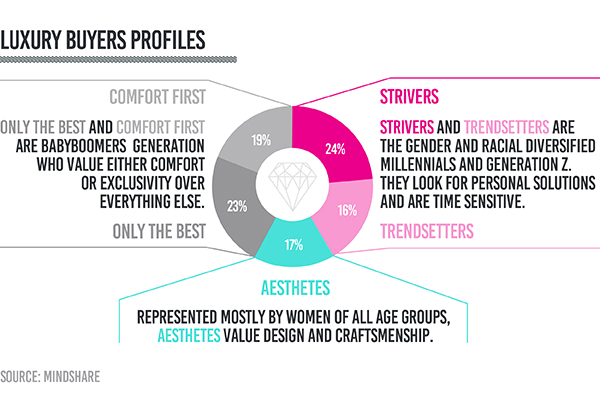

According to a luxury study by Bain&Co, 85% of luxury growth in 2017 is fueled by generation Y and Z. By 2025, they will represent forty percent of market consumers. For babyboomer, the reason for luxury shopping was an expression of status. Nowadays, luxury goods are personalized tools for self-expression. According to Mindshare’s study, there are five types of luxury buyers.

The first group called Strivers is the biggest one. Over a half of them represent a diversified group of 18-34 years old. At the moment, they are in their early career path with a potential to reach a high-income level in the upcoming decades. Strivers get their inspiration from social media, influencers, and peers. Thus it comes as no surprise that the luxury players are pushing on their presence in social media. For instance, Louis Vuitton, Gucci, Dior, D&G and Prada have over 15 million followers on Instagram. Gucci has doubled its followers account between 2016 and 2018 reaching 22 million on Instagram and almost 17 millions on Facebook. According to SocialWall, Burberry dedicates up to 60% of marketing budget to digital platforms. Strivers are looking for “the dream” and aspirations. In addition, as the group is multicultural and gender diverse, brands’ message should allow buyers to dream in their own way. The challenge is to transform “likes” into an engaging and interactive experience.

Trendsetters buyers profile takes 16% the volume. They want to be the first one to know about a new phenomenon and be the brightest ones in the group. As well as Strivers, Trendsetters are young and multicultural. 46% of the group are under 34 years old. The next profile is Aesthetes who prioritize aesthetics and design. They are strongly represented by females and equally distributed through age groups. Aesthetes value exemplary design and craftsmanship. They prefer to engage with makers and influencers themselves. Our of last purchases buyers mention travels, autos, and fashion.

Trendsetters buyers profile takes 16% the volume. They want to be the first one to know about a new phenomenon and be the brightest ones in the group. As well as Strivers, Trendsetters are young and multicultural. 46% of the group are under 34 years old. The next profile is Aesthetes who prioritize aesthetics and design. They are strongly represented by females and equally distributed through age groups. Aesthetes value exemplary design and craftsmanship. They prefer to engage with makers and influencers themselves. Our of last purchases buyers mention travels, autos, and fashion.

The last two groups represent babyboomers. Only the Best and Comfort First take almost half of the buyers profiles. They have high incomes and the values from the last century. Both of them prefer traveling in the best and most comfortable ways. Thus, Comfort First profilers expect a brand to downplay status and image. While Only the Best want to reflect the leadership and high performance of the brands.

Next Era

Luxury Logistics

Luxury has to become closer to people. Playing hard-to-get creates a distance between customers and brands rather than creating a value. Thus, taking up on this challenge, Valentino partners up with Yoox Net-a-Porter to create a superior Next Era retail experience. New user-management and logistics platform reinvent Valentino’s operations. Next Era creates a management system that seamlessly connects buyers and products globally. Valentino’s online and brick and mortar flagship stores are interconnected with e-commerce. “Whether they want to shop online, pick up in-store, have items delivered to separate locations, the options are endless,” points out Federico Marchetti, YNAP chief executive. At the same time, the solution gathers the information on consumers behavior which will enable on-site personalization and contextual searches.

McKinsey expects a tripling of online sales by 2025, reaching €74 billion globally. Taking a 20% share of the whole luxury retail, digital commerce grows via multi-brand platforms rather than mono-brand stores. One of the reasons is that the first one manages to build scalable business models and more developed logistics chains. What is expected in the future is reverse omnichannel. Store experience has to be able to reflect the comfort and personalization of online shopping. Nearly 80% of luxury purchases are digitally influenced. Before entering the physical store, buyer explores peers reviews and bloggers opinions. Thus, along with $15 billion investment in logistic services by 2023, Alibaba launched Luxury Pavillion. An invite-only platform has cooperation with over 50 brands providing clients with “access to exclusive offers, celebrity events, flexible payment options, priority purchases and door-to-door returns.”

Shift to Asia

In 2017, the share of global personal luxury goods purchased in Chinese nationals reached 32%. At the same time, Japanese spendings showed 4% growth up to €22 billion. Similarly, the rest of the Asian market’s sales increased by 6%. What is interesting, the luxury personal goods demand expands to traveling and shopping while on the trips. The luxury logistical footprint grows on the international scale. Augmented reality commerce offers a new virtual shopping area that has no physical distance. Thus, the future luxury shoppers volume will be coming from Asia and virtual worlds that will have to be connected directly to the customers.